Lite

Simplifying fixed asset management

• Do you have an asset spreadsheet and you aren't quite sure how

it works?

• Do you have assets that don't seem to be depreciating? Unsure

about the totals? Have a hard to use system?

• Do you think it's too hard and just leave it up to your

accountants?

• Do you want to take more control of YOUR business?

• Do you want to quickly and accurately calculate

depreciation?

• Do you want a more secure system with an easy to use interface

for adding and updating your assets?

Then Very Impressive Assets Lite is the solution for you!

VI Assets Lite is our basic and inexpensive fixed asset solution designed with small businesses in mind who want to depreciate assets in a controlled, safe and secure environment. It makes for a great replacement of the 'unmanageable' spreadsheet which is often flawed by formula errors. You also don't have the risk of the person with the knowledge of the complex macros in your spreadsheet, walking out your door leaving you to work out how it was done. Lite allows you to record and depreciate assets for a single company maintaining one book. It has reports that can be used to record depreciation on a monthly or yearly basis for tax returns. It can be used stand alone or integrated with MYOB AccountRight version 16 and later.

How Lite Works

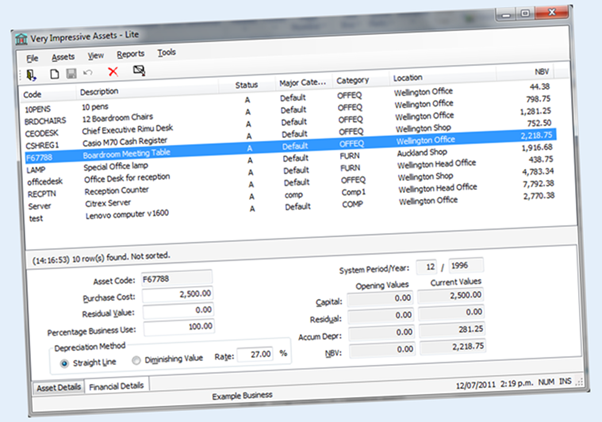

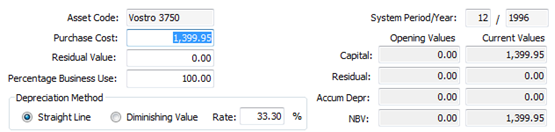

Once the asset category has been selected you will automatically be taken into the book details where you enter the purchase cost; select the depreciation method: Straight Line or Diminishing Value; and then enter the depreciation rate (these will be defaulted from the category selection).

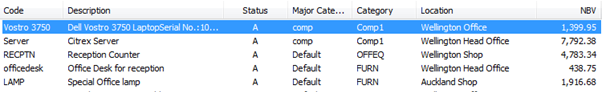

The newly added asset will now show in the asset listing

screen:

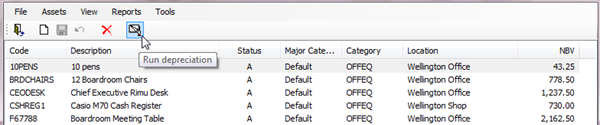

Calculating depreciation could not be easier - it just takes a

single click of the Run Depreciation button to do the calculation

for all your assets.

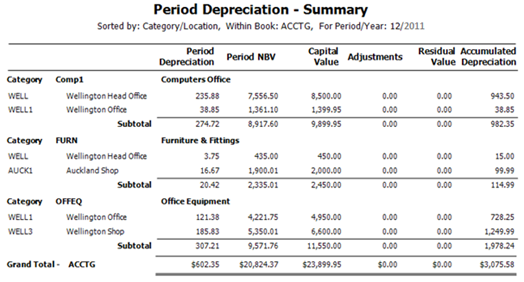

Lastly, use our easy to read reports to reconcile to your

accounting system then print them off physically or electronically

to keep on file.

The Benefits

![]() Saves Time and Money

Saves Time and Money

Calculate depreciation for all your assets with the click of a

button.

If GL integrated; use the posting facility to quickly post

transactions into your accounting system - no re-keying required,

eliminating risk of user error.

![]() Peace of mind

Peace of mind

Having a secure database where data can only be entered through an

interface ensures better data accuracy as well as making it easier

to update asset details and calculate depreciation.

![]() Convenient

Convenient

Can be used standalone or integrated with MYOB AccountRight Live

(plus some older versions of AccountRight) or MYOB

Essentials.

As your company grows and outgrows Lite, we have a family of asset

solutions, which you can cross grade to, designed to have the same

look and feel to ensure an easy transition, but with each upgrade

offering more features, functionality and benefits.